jefferson parish property tax rate

The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Jefferson Parish.

Louisiana Property Tax Calculator Smartasset

A mill is defined as one-tenth of one cent.

. To qualify for the Senior Citizens Special Assessment Level Homestead Exemption freeze you must meet both of the following. You must be 65 years of age or older by the end of the year in which you are applying. Ad Find Out the Market Value of Any Property and Past Sale Prices.

2016 Jefferson Parish Assessors Office. State St in Jennings at 10 am. A convenience fee of 249 is assessed for.

Millages Wards. Whether you are presently living here only contemplating taking up residence in Jefferson Parish or planning on investing in its property find out how municipal property taxes work. The telephone is 504-363-5637.

On the scheduled date. The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county sales tax. In Jefferson Parish eighteen different wards levy different millage rates.

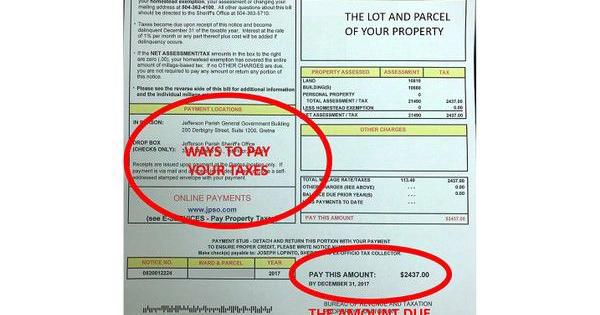

The median property tax also known as real estate tax in Jefferson Parish is 75500 per year based on a median home value of 17510000 and a median effective property tax rate of 043 of property value. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200 in Gretna and is open to the public from 830 am. Online Property Tax System.

As per LA RS 472153 all unsettled property taxes are read aloud to the people or Tax Buyers who are present. 1233 Westbank Expressway Harvey LA 70058. The average effective property tax rate in East Baton Rouge Parish is 061 which is over half the national average.

If you have questions about how property taxes can affect your overall financial plans a financial advisor in New Orleans can help you out. Groceries are exempt from the Jefferson Parish and. The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100.

You may call or visit at one of our locations listed below. Jefferson Davis Parish has one of the lowest median property tax rates in the country with only eighty three thousand seven hundred of the 3143. These taxes may be remitted via mail hand-delivery or filed and paid online via our website.

The Tax Sale is held at the Jefferson Davis Parish Courthouse located at 300 N. Payments are processed immediately but may not be reflected for up to 5 business days. If the parcel does not have a HEX then the.

Jefferson Davis Parish collects on average -1 of a propertys assessed fair market value as property tax. Property taxes are levied by millage or tax rates. With this guide you can learn useful information about Jefferson Parish property taxes and get a better understanding of what to anticipate when you have to pay.

Utilize our e-services to pay by e-check or credit card Visa MasterCard or Discover. For comparison the median home value in Jefferson Parish is 17510000. Due to the Annual Tax Sale this site can only be used to view andor order a tax research certificate.

200 Derbigny St Suite 1100 Gretna LA 70053. This income requirement changes annually. These buyers must pre-register with the Sheriffs Office prior to the sale in order to participate.

1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. 20 rows Jefferson Parish Wards. A 249 convenience fee is assessed on all credit card payments.

What is the sales tax rate in Jefferson Parish. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax. Louisiana is ranked 1929th of the 3143 counties in the United States in order of the median amount of property taxes collected.

Please contact the Jefferson Parish Sheriff 504-363-5710 for payment options. This gives you the assessment on the parcel. The 2018 United States Supreme Court decision in South Dakota v.

Most millage rates are approved when voted upon by voters of Jefferson Parish. Jefferson Parish Sheriffs Office. If a Homestead Exemption HEX is in place you would then subtract 7500 75000 HEX x 10 from the assessed value to get the taxable amount.

The median property tax in Jefferson Davis Parish Louisiana is -1 per year for a home worth the median value of 2560. Jefferson Parish Sheriffs Office. The Jefferson Parish sales tax rate is.

Our office is open for business from 830 am. Administration Mon-Fri 800 am-400 pm Phone. Additionally you must meet the income requirement as set forth by the Louisiana legislature.

Only open from December 1 2021 - January 31 2022. Jefferson Parish collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by. The Louisiana state sales tax rate is currently.

The Jefferson Parish Sales Tax is collected by the merchant on all qualifying sales made within Jefferson Parish. 2021 Plantation Estates Fee 50000. Jefferson parish sheriffs office 200 derbigny street suite 1200 gretna la 70053 residents with questions about their property tax collection.

The jefferson parish assessors office determines the taxable assessment of property. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. 45215 When calculating the city millages for these municipalities you do not include the reduction from a Homestead Exemption.

This is the total of state and parish sales tax rates. Revenue derived from the various millage levies benefit numerous public services. To 430 pm Monday through Friday.

There is no fee for e-check payments. 350 on the sale of food items purchased for preparation and consumption in the home. To find an estimate of your yearly taxes you start by multiplying the current Market Value by 10.

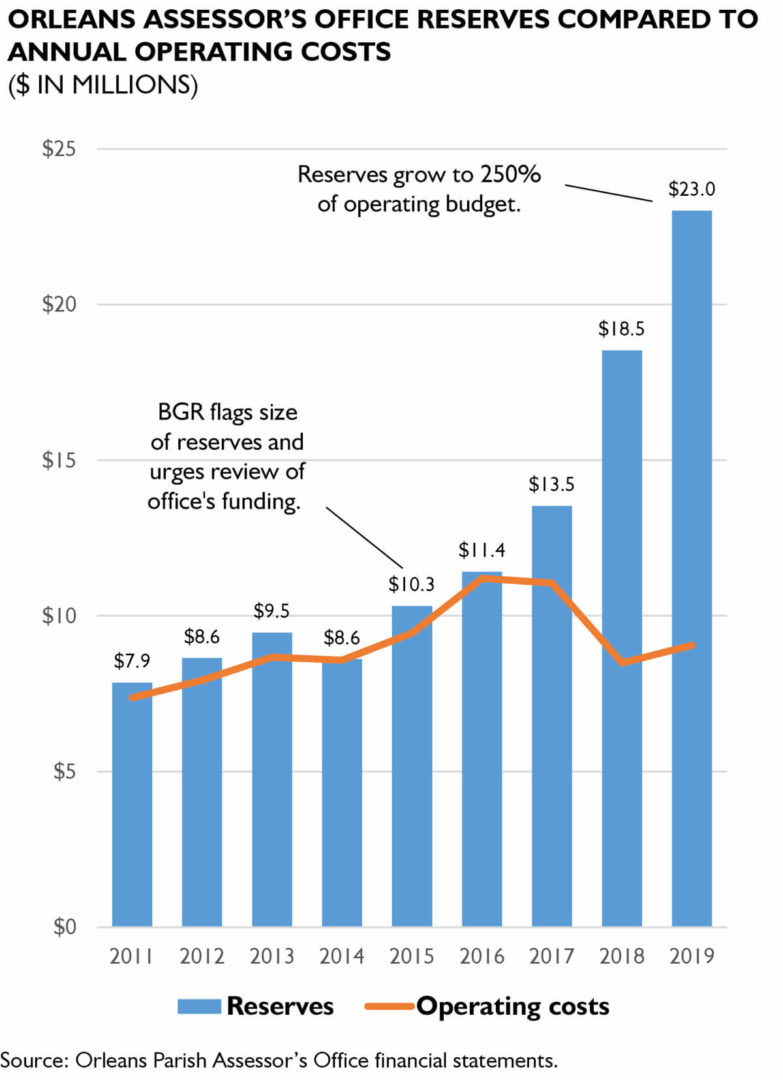

Policywatch Revisiting Assessment Issues In New Orleans

Louisiana Property Taxes Taxproper

Louisiana Property Tax Calculator Smartasset

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Kean Miller Wins Major Property Tax Case At Louisiana Supreme Court Louisiana Law Blog

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Louisiana Ranks Favorably In New Property Tax Analysis Biz New Orleans

Jefferson Parish Property Taxes Are Set For 2018 Local Politics Nola Com

Jefferson Parish Residents Will See Several Millages On Ballot

Louisiana Property Tax Calculator Smartasset

Property Tax Overview Jefferson Parish Sheriff La Official Website

Property Tax Overview Jefferson Parish Sheriff La Official Website

Property Tax Overview Jefferson Parish Sheriff La Official Website

What Is The Homestead Exemption And How Do I Apply For Or Renew It St Charles Parish Assessor S Office